Which Of The Following Institutions Determines The Quantity Of Money In The Economy As Its

What is the Quantity Theory of Money?

The quantity theory of money describes the relationship between the supply of money and the price of goods in the economy and states that percentage change in the money supply will be resulting in an equivalent level of inflation or deflation. An increase in prices will be termed as inflation while a decrease in the price of goods is deflation Deflation is defined as an economic condition whereby the prices of goods and services go down constantly with the inflation rate turning negative. The situation generally emerges from the contraction of the money supply in the economy. read more . That means if the money in the economy doubles then the price level of the goods also gets doubled which will be causing inflation and consumer will have to pay double the price for the same amount of goods or services.

Quantity Theory of Money Equation

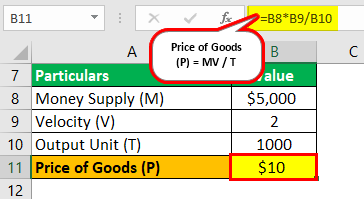

The quantity theory of money can be easily described by the Fisher equation. The value of money can be described by supply and demand of money the same as we determine the supply and demand of commodities. The equation for quantity theory of money can be described by

MV = PT

You are free to use this image on your website, templates etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Quantity Theory of Money (wallstreetmojo.com)

Where,

- M = Total amount of money in the economy.

- V = Velocity of circulation of money i.e. how many times money gets exchanged for goods/service.

- P = General price level in the economy.

- T = Total index of physical volume of transactions.

- PT can be defined as total expenditure in a given time.

Example of Quantity Theory of Money

Following the example of the quantity theory of money will help in understanding this better:

You can download this Quantity Theory of Money Excel Template here – Quantity Theory of Money Excel Template

Let's say a simple economy where 1000 units of outputs are produced, and each unit sells for $5. If there is a total amount of money involved in $2500 then below will be QTM equation:

Solution:

Given,

- M = $2500

- T = 1000

- P = $5

- V =?

Calculation of Velocity can be done as follows:

As per the Quantity Theory of Money equation

- MV = PT

- 2500 * V = 1000 * 5

Velocity (V) = 2

That means each dollar will change hands twice in the economy in the given period.

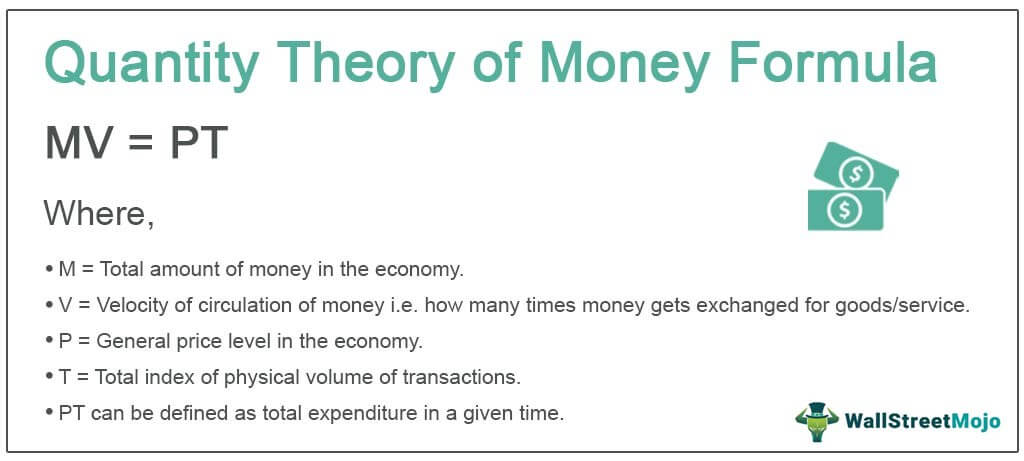

Let's say now the money supply increases to $5,000. The output unit and velocity of circulation will remain the same. So, we can see the new price of goods will be:

Calculation of Price of Goods can be done as follows:

Price of Goods (P) = MV/T

Price of Goods (P) = 5000*2/1000

Price of Goods (P) = $10

So here we can say if the money supply in the economy gets doubles then the price of goods also gets doubled to $10.

You can refer to the above given excel template for the detailed calculation of quantity theory of money.

Inflation in Argentina

In the 1980s inflation rates in countries like Argentina, Peru, Brazil was skyrocketing. The reason was high money supply in the economy. Argentina was having a very high fiscal deficit Fiscal deficit refers to the situation where the total budget expenditure exceeds the total budget receipts, excluding the government borrowings in a given fiscal year. It determines the amount the government needs to borrow for meeting its excess expenditure. read more and it was increasing each year and that's why the country was printing money to finance it. As the economy is having more money, that means more people can buy the goods and that's why the value of money decreases and the price of goods increases.

Source: tradingeconomics.com

Now with the above graph, we can see that the inflation rate in 1989 was more than 20,000%. That means one year before if the price of a good was 1 peso, then in 1989 it increased to 20,000 pesos. The only reason was, because fiscal deficit bank had to print more money and that's why the price increased, which proves the quantity theory of money phenomenon.

Advantages of Quantity Theory of Money

Some of the advantages are as follows:

- It brings out the relationship between money supply and price level in the economy.

- The equation is very simple and easy to understand.

- This equation has been supported by empirical evidence.

Limitations of Quantity Theory of Money

Some of the limitations are as follows:

- Its simplicity is one of its limitations. People know that it is an obvious fact that if the money supply will increase the price will decrease. It does not state the cause and effect of the increasing supply.

- This equation assumes that velocity and output of goods will remain constant and will not be affected by other factors but in actual change in any of these factors is changeable.

- It does not explain the trade cycle. If a decrease in money causes depression, then if we increase the amount of money then reversal or inflation should happen, but this is not the case in most times in actual.

- It is not useful in short term time frames. It is only useful for a long period.

- Some of this theory's elements are inconsistent. For example, P includes the price of all goods or services in the economy, but we know that the price movement of some goods is quite rigid compared to other goods. So, it is hard to say which price we are referring to in the equation.

Important Points

- The main point that the quantity theory of money states that the quantity of money will determine the value of money.

- So, in order to stop inflation, economies need to check the supply of money.

- This theory assumes that the output of goods and velocity remains constant.

Conclusion

Though the quantity theory of money has many limitations and it has been criticized also but it is having certain merits also. The quantity theory of money depends on the simple fact that if people will be having more money then they will want to spend more and that means more people will bid for the same goods/services and that will cause the price to shoot up. Though empirically the relationship between value and supply of money is not the directly proportionate one it can be seen in the past that excessive supply of money increases inflation.

Recommended Articles

This has been a guide to what is Quantity Theory of Money and its definition. Here we discuss the equation to calculate quantity theory of money along with examples, advantages, and limitations. You can learn more about accounting from following articles –

- Floating Exchange Rate

- Gross Income Multiplier

- Quantitative Easing

- Contractionary Monetary Policy

- Normative Economics

Which Of The Following Institutions Determines The Quantity Of Money In The Economy As Its

Source: https://www.wallstreetmojo.com/quantity-theory-of-money/

Posted by: isaacclibing.blogspot.com

0 Response to "Which Of The Following Institutions Determines The Quantity Of Money In The Economy As Its"

Post a Comment